Apply Now and Discover the Difference!

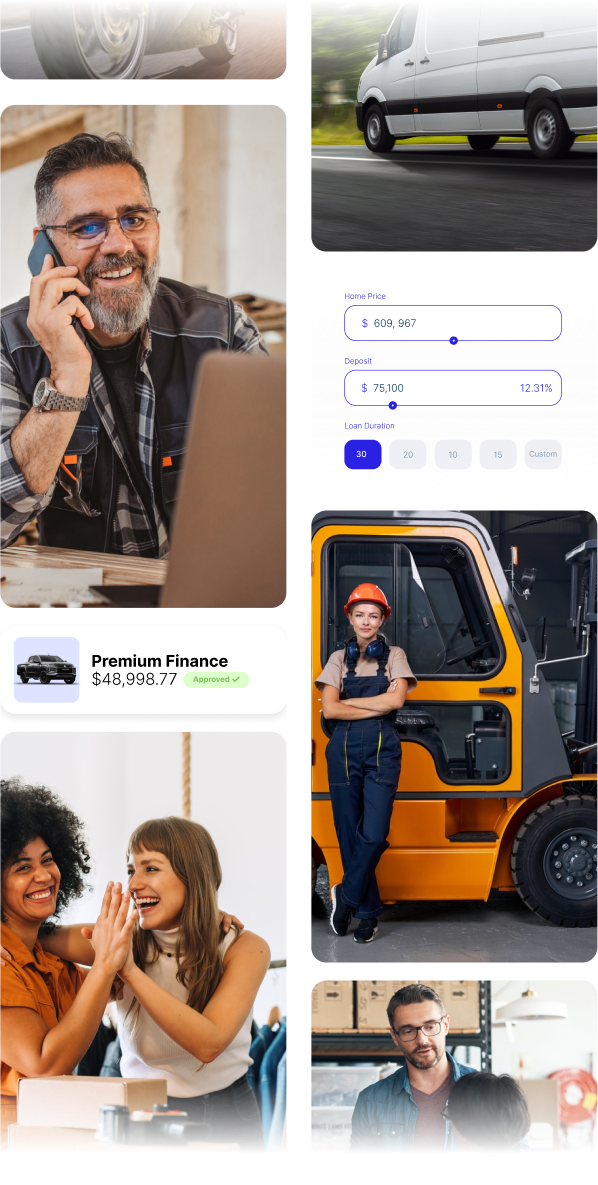

Why Choose Our Premium Finance Loans?

Looking to take your business to the next level? Look no further! Our premium business loans are tailored to meet your unique needs, offering you the financial support and flexibility required for growth and expansion. With our competitive interest rates and exceptional service, we are proud to be Australia's best choice for premium business loans.

Tailored Funding Solutions

Your business is one-of-a-kind, and so are your financing needs. Our premium business loans are designed to be fully customizable, providing funding solutions that align with your specific requirements. Whether you're looking to invest in equipment, expand your operations, or seize new opportunities, our loans can be tailored to suit your business goals.

Fast and Efficient Process

Time is money, and we value your time. Our application process for premium business loans is designed to be fast, efficient, and hassle-free. Say goodbye to lengthy paperwork and endless waiting. With our streamlined approval process, you can get the funding you need promptly, allowing you to seize opportunities and stay ahead of the competition.